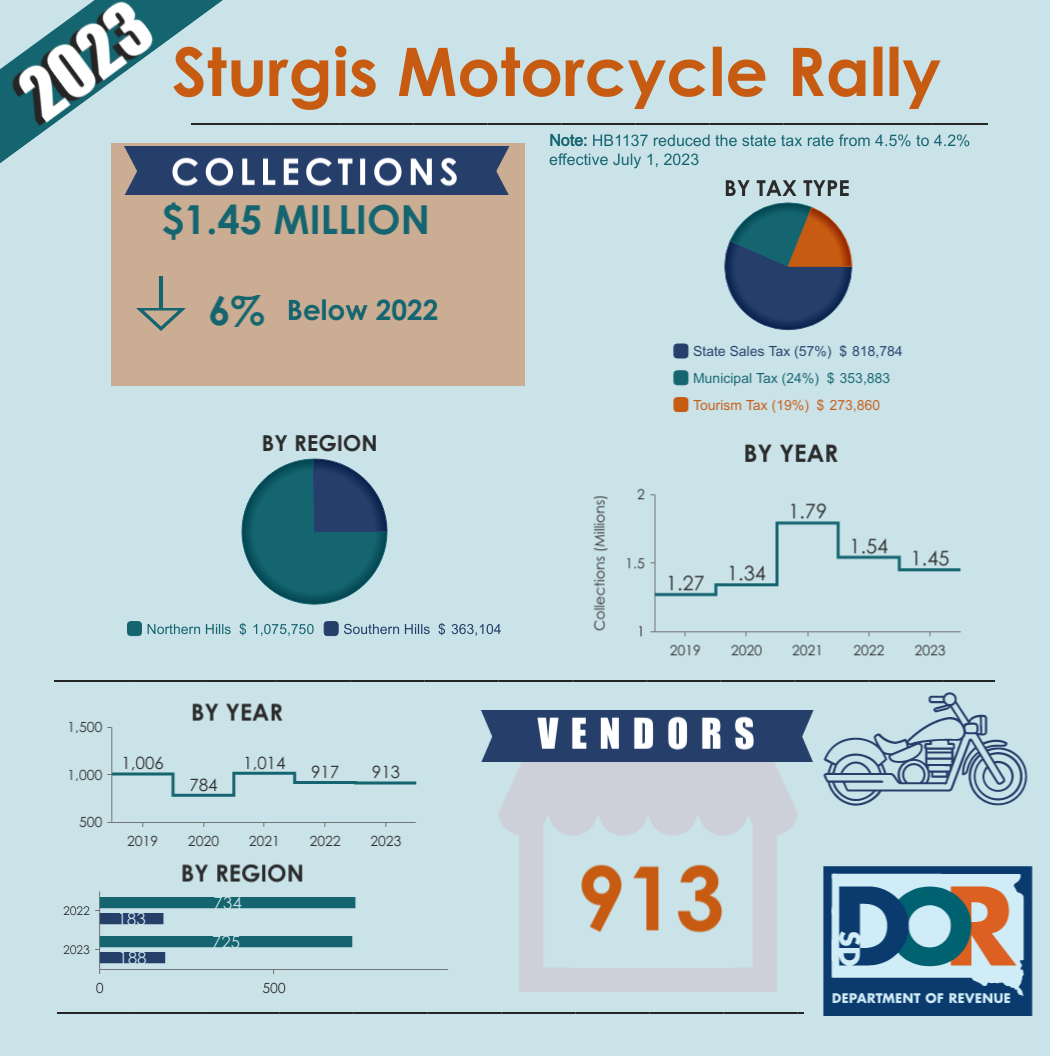

Tax revenue $1.45 million at 2023 Sturgis Motorcycle Rally

PIERRE, S.D., -- The South Dakota Department of Revenue estimates that tax collections from the 2023 Sturgis Motorcycle Rally were $1,446,526.

The revenue sum from temporary vendors in the Black Hills was down 6 percent compared to 2022. The state sales tax accounted for the majority of the collections with $818,784. At this time last year, the department had collected $902,399 in state sales tax. The department’s 2023 collections also include $273,860 in state tourism tax and $353,883 in municipal taxes. A portion in this year’s decrease can be attributed to the reduction in the state tax rate from 4.5% to 4.2% which took effect July 1, 2023.

The 2023 rally had 913 temporary vendors. Temporary vendors attending the 2023 Sturgis Motorcycle Rally were on par with those visiting in 2022, with only four less in attendance.

The Northern Black Hills, which includes Sturgis and all other communities in Meade and Lawrence counties, accumulated $1,075,750 in tax from the 725 vendors present, an 8% decrease from a year ago.

The Southern Black Hills, which includes Rapid City, Custer, Hill City, and Keystone, had 188 temporary vendors with $363,104 in total tax collected, decreasing 5% from 2022.

Taxes collected at the 2023 Sturgis Motorcycle Rally included state sales tax, tourism tax, municipal sales tax, and municipal gross receipts tax.