PIERRE, S.D. – The Department of Revenue’s Motor Vehicle Division will launch a new title and registration system, 605Drive, on February 17, 2025.

Training for the new system began on December 9, 2024, with basic trainings for county and internal users. Since then, 18,060 computer-based training modules have been assigned to county users. Fifty-one counties have completed 80% of those training courses.

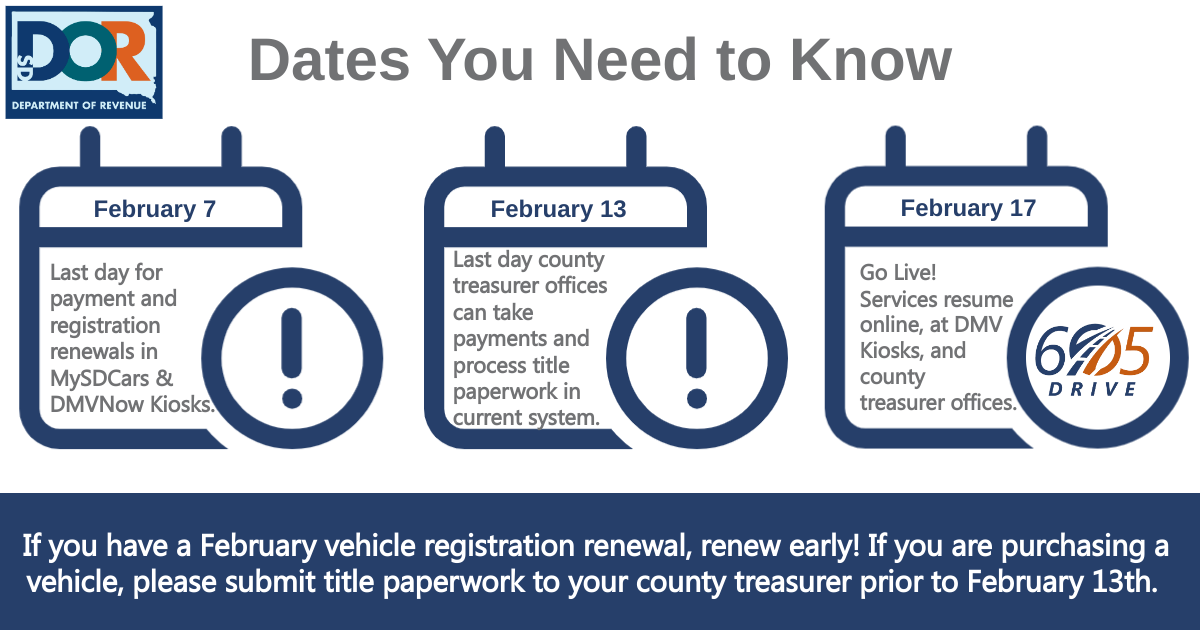

The transition to the new system will occur in three phases. Starting on February 7, registration renewals will not be available on mySDCars.gov or at the DMVNow Kiosks. Registration renewals will continue to be available at county offices through 7 PM Central Time on February 13th although we recommend checking with your treasurer's office to see if they have an earlier stop time to work through their end-of-day processes.

Between February 14 – 16, 2025, motor vehicle transactions, including title transfers and registration renewals, will not be available. During that same time, the system transition will also delay a dealership’s ability to transfer a title and a financial institution’s ability to release liens.

The new system will launch on February 17, 2025. Access to registrations will be available at county treasurer offices, DMVNow Kiosks, and through the new online platform, whose link can be found on the Department’s website at dor.sd.gov by clicking “Vehicle Registration and Plates” under Online Services.

The Department recommends vehicle owners who renew in February renew their registration early to avoid any delays.