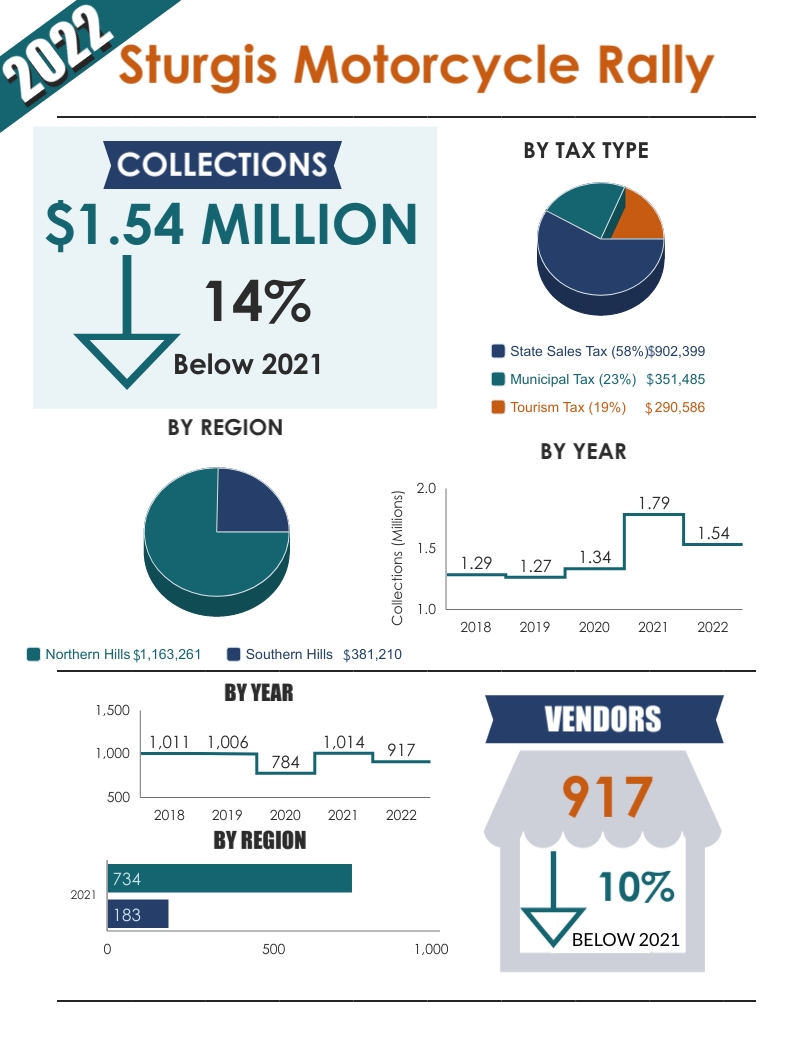

The Department of Revenue’s tax collections at the 2022 Sturgis Motorcycle Rally are currently at $1,544,471.

The revenue sum from temporary vendors in the Black Hills was down 14 percent compared to 2021. The state sales tax accounted for the majority of the collections with $902,399. At this time last year, the department collected $1,038,561 in state sales tax. The department’s 2022 collections also include $290,586 in the state tourism tax and $351,485 in municipal taxes.

“After coming off of record numbers from 2021, 2022 saw a decrease in revenue but still overall strong figures.” Revenue Supervisor Lori Haupt said. “Revenue staff saw many returning vendors coming back to the rally in both the northern and southern hills. South Dakota continues to be open for business and a great place to visit.”

Temporary vendors attending the 2022 Sturgis Motorcycle Rally were also down 10% compared to 2021. The 2022 rally topped at 917 temporary vendors, while the 2021 event had 1,014.

The Northern Black Hills, which includes Sturgis and all other communities in Meade and Lawrence counties, accumulated $1,163,261 in tax from the 734 vendors present, a 13% decrease from a year ago.

The Southern Black Hills, which includes Rapid City, Custer, Hill City, and Keystone, had 183 temporary vendors with $381,210 in total tax collected, decreasing 16% from 2021.

Taxes collected at the 2022 Sturgis Motorcycle Rally included state sales, tourism, municipal sales, and municipal gross receipts.