Businesses

Motor Carrier Services

The Motor Vehicle Division, Motor Carrier Section, provides a one stop shop for both the IRP / IFTA for South Dakota based interstate commercial trucking operations. Learn more below or visit SDtruckinfo.com. If you have additional questions regarding your IRP / IFTA license, please contact us at (605) 773-3541 or sdmotorcarrier@state.sd.us.

Quick Navigation

International Registration Plan (IRP)

International Fuel Tax Agreement (IFTA)

Commercial Permit

Heavy Vehicle Use Tax

Unified Carrier Registration Program

Find Out More

Education

Other Motor Carrier Service Resources

Title VI Program

Motor Carrier Online Forms

International Registration Plan (IRP)

Vehicles used to transport items weighing more than 500 pounds. (for business purposes) must be commercially licensed. If your vehicle travels only in South Dakota, you must obtain an in-state commercial license from your county treasurer’s office. However, if you use that vehicle outside South Dakota, you must either obtain a trip permit or have an IRP license (also referred to as a prorate license). These licenses are issued only by the Motor Carrier Services, a section of the Department of Revenue Motor Vehicle Division. The heavy vehicle use tax applicable on commercial registrations over 27 ton, also apply to IRP registrations over 27 ton. For more information, visit SDTruckInfo.com. or IRP Frequently Asked Questions (PDF).

If you are registered and would like to access our online registration and IFTA filing system, please click on the link below.

License

The cost of a prorate license depends on two factors; the fee schedule in each state in which your vehicles travel and the percent of miles traveled in each state of the total miles that your vehicles travel. Fees, which vary from state to state, are typically based on:

- The weight of a vehicle;

- Its model year;

- Its value; and

- Some combination of weight, model year, and value.

The cost of a license also depends on the percentage of miles traveled in each state by each vehicle. For instance, if 60 percent of the miles a vehicle travels are in South Dakota and the remaining 40 percent in Minnesota, 60 percent of the IRP license cost will be based on South Dakota’s fee schedule and the remaining 40 percent on Minnesota’s fee schedule. South Dakota also collects excise tax on most vehicles where title is being transferred. The tax rate is 4%; however, on a prorate licensed vehicle, the tax is also based on the percentage of miles for South Dakota.

Cost

Once your application is received, the office will calculate the cost of your license and send you a bill.

- Return the top portion of the bill along with your payment made payable to the South Dakota Department of Revenue. Payments received after 30 days of the billing date in which temporary clearance has been issued will be assessed a penalty of $10.00 or 10% if the billing; whichever is greater and interest of 1.5%. Interest is assessed monthly until a payment is received.

- After payment has been received, you will be sent license plates/decals and cab cards covering the vehicles you have licensed. Review these to make sure they are correct. Corrections requested more than 15 days after receipt will be charged $3.00 per cab card.

Temporary Clearances

To receive a temporary clearance, you must first complete the IRP Application. You will then calculate and submit an advanced deposit. The advanced deposit must be submitted with the application and all other required documents. This temporary clearance allows interstate travel in the same manner as a permanent prorate license but is only valid for a maximum of 45 days or until the end of the current registration year.

International Fuel Tax Agreement (IFTA)

The International Fuel Tax Agreement simplifies the reporting of all fuel (gasoline, diesel, propane, and gasohol) use taxes by commercial motor carriers. The agreement allows a trucker/company to obtain one fuel tax license, issued by their base jurisdiction, authorizing them to travel in all IFTA member jurisdictions.

If you are registered and would like to access our online registration and IFTA filing system, please click on the link below.

License

If you are a motor carrier who operates a qualified vehicle used, designed, or maintained to transport people or property that:

- Have two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds (11,797 kilograms); or

- Have three or more axles, regardless of the weight; or

- Are used in combination when such combination exceeds a gross vehicle weight of 26,000

And you have an established base jurisdiction that will distribute the appropriate amount of tax owed to each IFTA member jurisdiction for you. South Dakota will be your base jurisdiction if:

- Your vehicle(s) are registered in South Dakota;

- Your vehicle(s)’s use is controlled from a location in South Dakota; and

- Your vehicle(s)’s records are maintained or can be made available

Cost

The IFTA annual license is $10. Annual decals sets are $2.50. Commercial trucking operations are required to file quarterly motor fuel returns. Return may be filed through our online portal at SD Interstate Online. Returns are due by the last day of the following month. For additional information on returns and due dates, please see our Interstate Online FAQ.

Starting in July 2020, business will be required to file returns electronically.

Licensing Process

Please use our new account checklist to make sure you have completed all of the forms necessary to obtain your licenses. The licensing process for a new applicant is composed of the following steps:

-

- Apply for a new motor carrier account

- Agreement to Maintain Records

- Power of Attorney (if applicable)

- Proof of residency:

Commercial Permit

The owner of a commercial vehicle who has returned the current commercial plates and has since shown a need to operate this motor vehicle (unladen operation) on the highway can obtain a temporary commercial single trip permit. The fee for a commercial single trip permit is $15. Visit the SD Truck Info website for more permit information.

South Dakota 30-Day Commercial Permit Schedule

A fee of $7 is added for each additional ton.

Heavy Vehicle Use Tax (HVUT)

Vehicles requiring tonnage of 28 ton or greater must supply to the county treasurer a stamp verified copy of Form 2290, Schedule 1 (proof of filing/payment of the Federal Heavy Vehicle Use Tax) at the time of registration for the most current tax period. These tonnage decals are mailed to the vehicle owner from the Division of Motor Vehicle's Pierre office upon verification of proper filing through the online Motor Vehicle Registration & Plates portal. Tonnage decals of less than 28 ton are issued by the county and do not require the Form 2290.

For more information regarding HVUT, click here to check out our frequently asked questions.

Unified Carrier Registration Program

The Unified Carrier Registration (UCR) Plan and Agreement are part of a Federally-mandated, state-administered program. Under this program, states collect fees from motor carriers, motor private carriers, freight forwarders, brokers and leasing companies, based on the number of qualifying commercial motor vehicles (CMVs) in their fleets.

Who is Subject to the UCR Agreement?

If you operate a tractor, truck, or bus in interstate or international commerce, the registration requirements of the Unified Carrier Registration Agreement (UCR) apply to your business. This requirement also includes companies operating as brokers, freight forwarders, or leasing companies that are not combined with a motor carrier entity and make arrangements for the transportation of cargo and goods in interstate or international commerce. Motor carriers operating only as private motor carriers of passengers are not required to register and pay fees under UCR. Commercial Motor Vehicle: A “commercial motor vehicle” is a self-propelled vehicle used on the highways in commerce principally to transport passengers or cargo, if the vehicle:

- has a gross vehicle weight rating or gross vehicle weight of at least 10,001 pounds, whichever is greater;

- is designed to transport 10 or more passengers, (including the driver); or

- is used in transporting hazardous materials in a quantity requiring placarding.

Fees Under the Unified Carrier Registration Plan and Agreement for Registration Year 2022

| Bracket | Number of CMVs owned or operated by exempt or non-exempt motor carrier, motor private carrier, or freight forwarder | Fee per entity for exempt or non-exempt motor private carrier, or freight forwarder |

|---|---|---|

| 1 | 0-2 | $59 |

| 2 | 3-5 | $176 |

| 3 | 6-20 | $351 |

| 4 | 21-100 | $1,224 |

| 5 | 101-1,000 | $5,835 |

| 6 | 1,001 and above | $56,977 |

If you have additional questions about a UCR Registration, please contact our office at (605) 773-3541 or sducr@state.sd.us.

Find Out More

Discover even more South Dakota trucking information, including the following:

- IFTA Manual

- IFTA Return Instructions & FAQ

- Current Tax Rates

- IRP Manual

- IRP FAQ

- UCR Unified Carrier Registration

- Permits

Education

The Motor Vehicles Division provides one-on-one training for IRP and IFTA and will do special request training.

New Motor Carrier Account

Motor Carrier Connect (MCC) Videos

Motor Carrier Connect (MCC) New System Training

Motor Carrier Connect (MCC) New System Overview

Motor Carrier Connect (MCC) User Guides

- Motor Carrier Connect Password Reset

- Add A Unit

- Amend an IFTA Return

- IFTA Return Instructions

- Print License Card

- Print Temporary Cab Card

- Renew A Fleet

Connect to Motor Carrier Connect

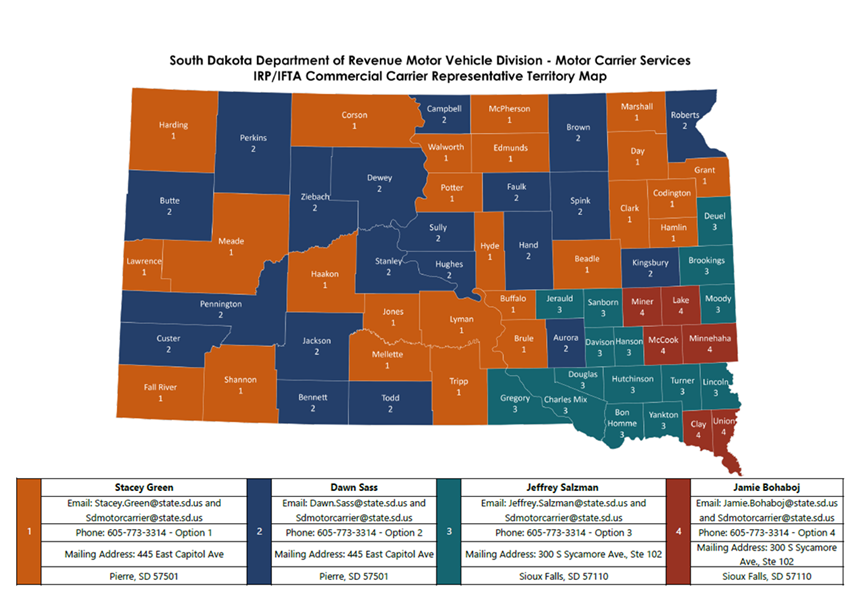

Motor Carrier Agents

Motor Carrier agents answer questions, provide training, and assist with fleet maintenance for businesses and individuals operating commercial trucking operations. In addition, they also help with registration under the International Registration Plan (prorate) and International Fuel Tax Agreement (IFTA) for vehicles traveling across state lines and assist with filing quarterly IFTA returns.

Other Motor Carrier Service Resources

- Estimated Mileage Justification Form (PDF)

- Estimated Mileage Statement (PDF)

- Harvest Letter (PDF)

- South Dakota IRP Manual (PDF)

- UCR Registration

- MCS 150 Form

- About Form 2290

- Federal Motor Carrier Safety Administration Forms

Notice of Title VI Program Rights

The SD Department of Revenue gives public notice of its policy to uphold and ensure full compliance with the non-discrimination requirements of Title VI of the Civil Rights Act of 1964 and related non-discrimination authorities. Title VI and related non-discrimination authorities stipulate that no person in the United States of America shall on the grounds of race, color, national origin, sex, age, disability, income level, or limited English proficiency be excluded from the participation in, be denied the benefits of, or be otherwise subjected to discrimination under any program or activity receiving federal financial assistance.

Any person who believes they have, individually or as a member of any specific class of persons, been subjected to discrimination on the basis of race, color, national origin, sex, age, disability, income level, or limited English proficiency has the right to file a formal complaint. Any such complaint must be in writing and submitted within 180 days following the date of the alleged occurrence to:

Title VI Program Coordinator

South Dakota Department of Revenue

Motor Vehicle Division

445 E Capitol Ave.

Pierre, SD 57501

For more information, click here.

Motor Carrier Services Online Forms

Frequently Asked Questions

Questions and answers about International Registration Plan and SD trucking information.

The International Registration Plan (IRP) is a registration reciprocity agreement between the 59 contiguous United States and Canadian provinces that are members of the plan, which provides apportioned payments of registration fees, based on the total distance operated in participating jurisdictions. An IRP license allows a trucker to obtain a single license plate for operation in any member jurisdiction.

Apportionable vehicles must be registered under IRP. The Plan defines an Apportionable vehicle as: any vehicle that is used or intended for use in two or more member jurisdictions and that is used for the transportation of persons for hire or designed, used, or maintained primarily for the transportation of property, and:

(i) has two axles and a gross vehicle weight or registered gross vehicle weight in excess of 26,000 pounds (11,793.401 kilograms), or

(ii) has three or more axles, regardless of weight, or

(iii) Is used in combination, when the gross vehicle weight of such combination exceeds 26,000 pounds (11,793.401 kilograms).

Exceptions: Recreational vehicles, vehicles displaying restricted plates, or government-owned vehicles.

Optional: Trucks or truck tractors, or combinations of vehicles having a gross vehicle weight of 26,000 pounds (11,793.401 kilograms), or less.

Learn more in the South Dakota IRP Manual (PDF).

Please contact our office or sdmotorcarrier@state.sd.us for a new account packet to be mailed or emailed to you. You can also obtain the information on SDtruckinfo.com.

South Dakota offers staggered registration months for IRP renewals. There are 4 different months renewals take place. When your account is set up we will determine which of the renewal months you will have. The months to file are February, May, August and November. Once your renewal month is established it will be the same time each year. We will send out a renewal packet to you about 45 days before the renewal is due.

After your first year of licensing, the Division of Motor Vehicles will send you a Renewal Application and Vehicle Information form at least 45 days before the expiration deadline. The Renewal form will list your licensed vehicles and all the pertinent information about those vehicles.

Your license will NOT be renewed if your DOT number is out of service, you are delinquent in filing your tax returns or if you owe any taxes, owe on an audit, or have a delinquent IFTA account.

If you do not pay your renewal on time the current tags will expire and you will not able to conduct business until you receive your new registration and tags. Keep in mind there are no temporaries allowed on renewals.

You can do this by contacting the Prorate office in writing with your request. If you have online access you are able to complete the request on the website. Once the request has been processed you will be able to make a payment and your credentials will be mailed to you.

Any time a change occurs in the name of your account or in the ownership of the business (corporate officers, partners or owners}, a new "Ownership Information Form" must be completed. This form must be completed in its entirety; even if there have been no changes in ownership from what was reported previously. A written statement must also be completed for a change in the business name.

If you have had a change of operation, prior written approval must be received from the division before any carrier will be allowed to use the estimated distance. Send your written request explaining the change to the Office of Prorate and Commercial Licensing.

For more information on IRP, contact us at sdmotorcarrier.state.sd.us. You can also find more info at www.sdtruckinfo.com and www.irponline.org.

The Unified Carrier Registration (UCR) Plan and Agreement are part of a Federally-mandated, state-administered program that went into effect September 10, 2007. Under this program, States collect fees from motor carriers, motor private carriers, freight forwarders, brokers and leasing companies, based on the number of qualifying commercial motor vehicles (CMVs) in their fleets.

If you operate a tractor, truck, or bus in interstate or international commerce, the registration requirements of the Unified Carrier Registration Agreement (UCR) apply to your business. This requirement also includes companies operating as brokers, freight forwarders, or leasing companies that are not combined with a motor carrier entity and make arrangements for the transportation of cargo and goods in interstate or international commerce.

Motor carriers operating only as private motor carriers of passengers are not required to register and pay fees under UCR. Commercial Motor Vehicle: A “commercial motor vehicle” is a self-propelled vehicle used on the highways in commerce principally to transport passengers or cargo, if the vehicle:

- has a gross vehicle weight rating or gross vehicle weight of at least 10,001 pounds, whichever is greater;

- is designed to transport 10 or more passengers, (including the driver); or

- is used in transporting hazardous materials in a quantity requiring placarding.